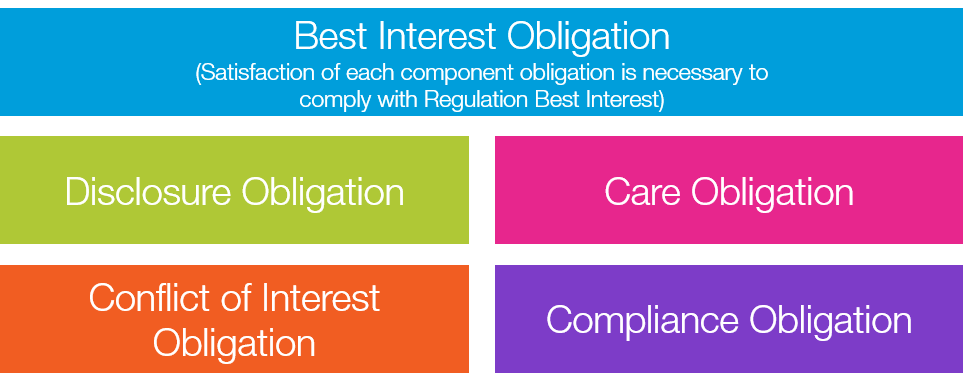

Best Interest Obligation

A Broker-Dealer, when making a recommendation of any securities transaction or investment strategy involving securities (including account recommendations) to a retail customer, shall act in the best interest of the retail customer at the time the recommendation is made, without placing the financial or other interest of the Broker-Dealer making the recommendation ahead of the interest of the retail customer.Disclosure Obligation

The Broker-Dealer, prior to or at the time of the recommendation, provides the retail customer, in writing, full and fair disclosure of:-

All material facts relating to the scope and terms of the relationship with the retail customer, including:

(i) that the Broker-Dealer is acting as a broker, dealer, or an associated person of a broker or dealer with respect to the recommendation;

(ii) The material fees and costs that apply to the retail customer’s transactions, holdings, and accounts; and

(iii) The type and scope of services provided to the retail customer, including any material limitations on the securities or investment strategies involving securities that may be recommended to the retail customer; and - All material facts relating to conflicts of interest that are associated with the recommendation.

Care Obligation

The Broker-Dealer, in making the recommendation, exercises reasonable diligence, care, and skill to:- Understand the potential risks, rewards, and costs associated with the recommendation, and have a reasonable basis to believe that the recommendation could be in the best interest of at least some retail customers;

- Have a reasonable basis to believe that the recommendation is in the best interest of a particular retail customer based on that retail customer’s investment profile and the potential risks, rewards, and costs associated with the recommendation and does not place the financial or other interest of the Broker-Dealer ahead of the interest of the retail customer;

- Have a reasonable basis to believe that a series of recommended transactions, even if in the retail customer’s best interest when viewed in isolation, is not excessive and is in the retail customer’s best interest when taken together in light of the retail customer’s investment profile and does not place the financial or other interest of the Broker-Dealer making the series of recommendations ahead of the interest of the retail customer.

Conflict of Interest Obligation

The Broker-Dealer establishes, maintains, and enforces written policies and procedures reasonably designed to:- Identify and at a minimum disclose or eliminate, all conflicts of interest associated with such recommendations;

- Identify and mitigate any conflicts of interest associated with such recommendations that create an incentive for a natural person who is an associated person of a broker or dealer to place the interest of the Broker-Dealer, or such natural person ahead of the interest of the retail customer;

- (i) Identify and disclose any material limitations placed on the securities or investment strategies involving securities that may be recommended to a retail customer and any conflicts of interest associated with such limitations, in accordance with subparagraph (a)(2)(i), and

- (ii) Prevent such limitations and associated conflicts of interest from causing the Broker-Dealer to make recommendations that place the interest of the Broker-Dealer ahead of the interest of the retail customer; and

- Identify and eliminate any sales contests, sales quotas, bonuses, and non-cash compensation that are based on the sales of specific securities or specific types of securities within a limited period of time.

Compliance Obligation

This is the catch-all provision for firms. Under Reg BI Broker-Dealers are required to establish, maintain, and enforce written policies and procedures reasonably designed to achieve compliance with Regulation Best InterestSubscribe to Our APREGBI (SaaS) Solution

Unlock the full potential of your regulatory requirements for Regulation BI with our tailored SaaS solution.

Call Now: 1-844-RISK-411Our Features

- Broker access to trades (T+1): Enable brokers to easily access and manage trades with next-day trade processing.

- Broker input to selected fields: Give brokers the ability to input crucial data in customizable fields.

- Broker Entry Screens with Full Audit Trail: Keep track of all broker activities with a comprehensive audit trail for transparency.

- Supervisor/Compliance Review: Empower compliance and supervisory teams to review all broker activity in real-time.

- Timestamp Entries: All entries are recorded with accurate timestamps for easy tracking.

- Custom Reports: Generate reports on a daily, weekly, or monthly basis, available in PDF format.

- Archiving Data (SEC 17a-4 Compliant): Securely archive data in compliance with SEC regulations.

- Compliance/Supervisor Dashboard: Provide supervisors and compliance teams with a dashboard for reviews and audit trails.

- Many-to-Many Supervision Relationships: Facilitate various levels of supervision across teams.

- Email Notifications: Automated email notifications to brokers and supervisors.

- Email Two-Factor Authentication (TFA): Enhance security with email-based two-factor authentication.

- Secure Website: A robust, secure platform designed to protect your data.

- Data Integration via SFTP: Seamlessly integrate data from various clearing firms via SFTP.

- Customized Firm Portals: Create personalized portals for each firm.

- Customized Reports: Design customized reports to meet your specific needs.

How to Subscribe

1. Call Us: Reach out to our dedicated team at 1-844-RISK-411.

2. Consultation: We'll discuss factors like the size of your firm, number of representatives, and data sources for seamless integration.

Why Choose Us?

- Personalized Service: We take a hands-on approach to meet your specific needs.

- Expert Support: Our team is equipped with the knowledge to guide you.

- Seamless Integration: We ensure our solution fits perfectly with your systems.

Ready to get started? Call us today at 1-844-RISK-411 to optimize your business operations with our SaaS solution.

Call Us Now